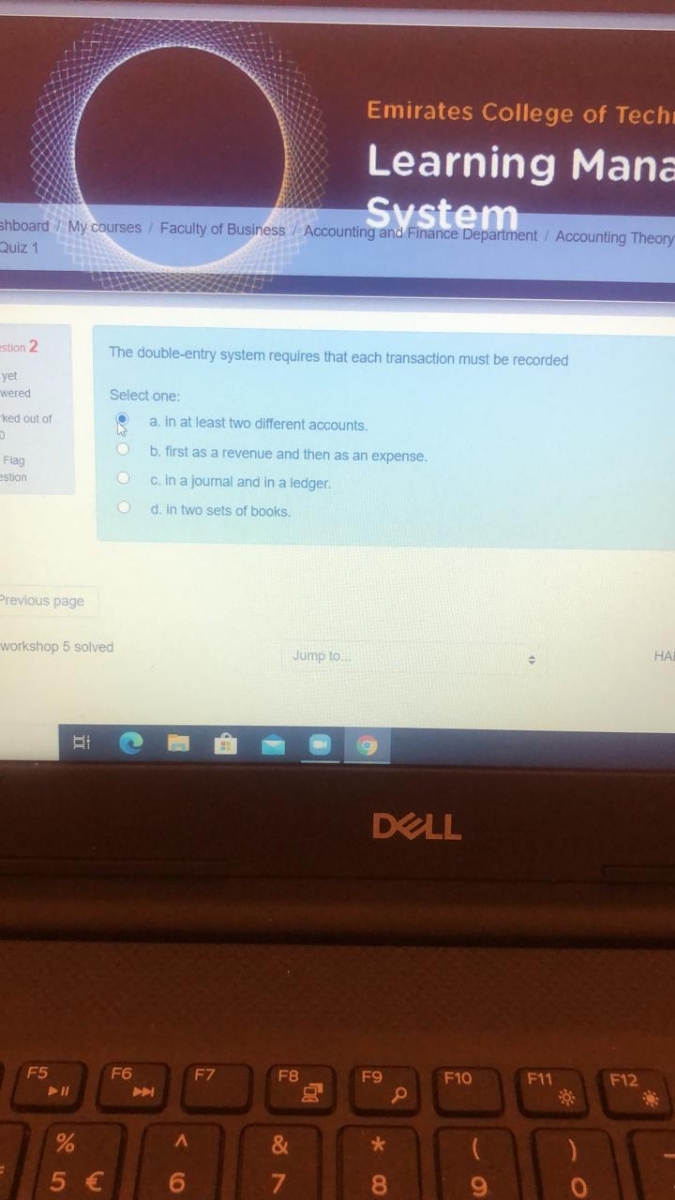

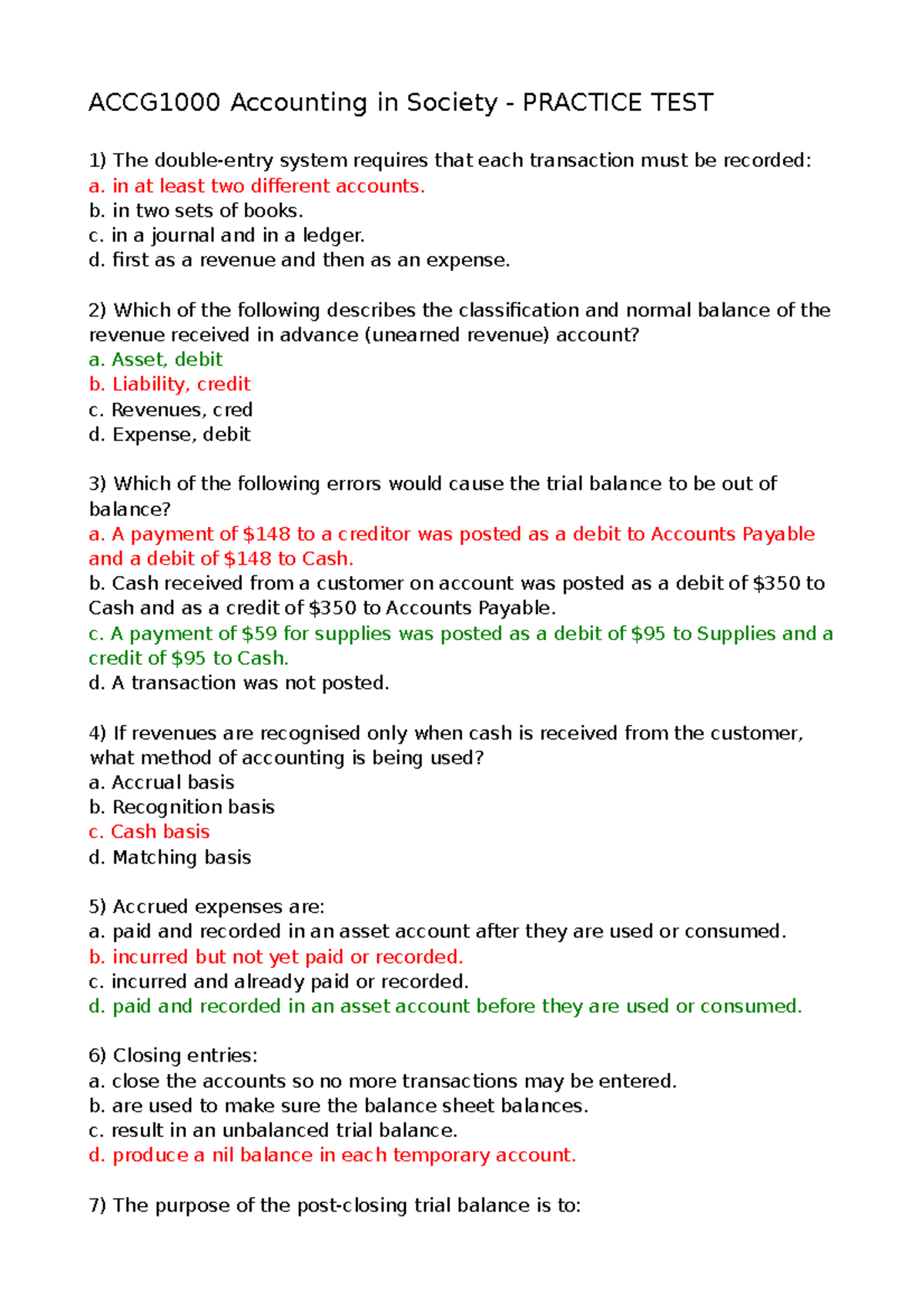

The Double-entry System Requires That Each Transaction Must Be Recorded

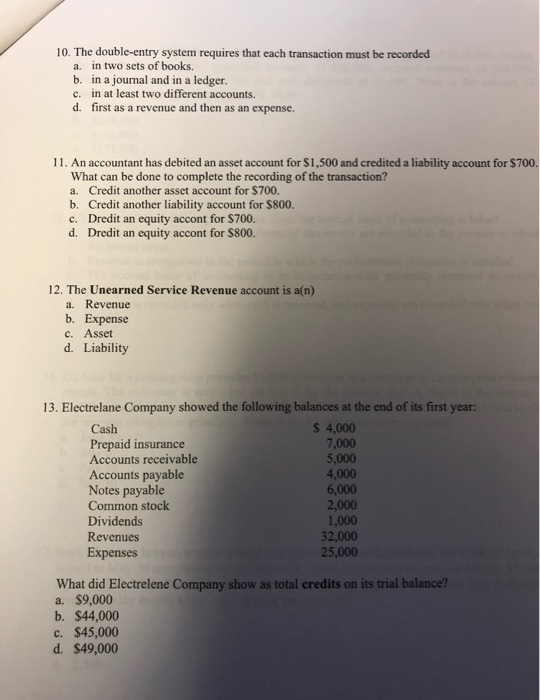

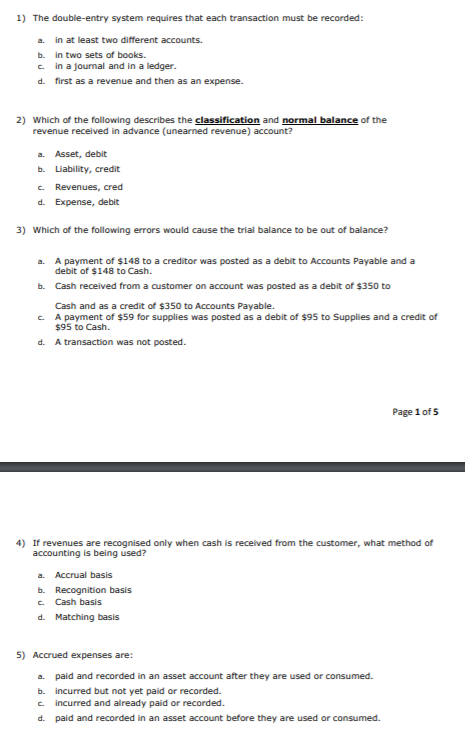

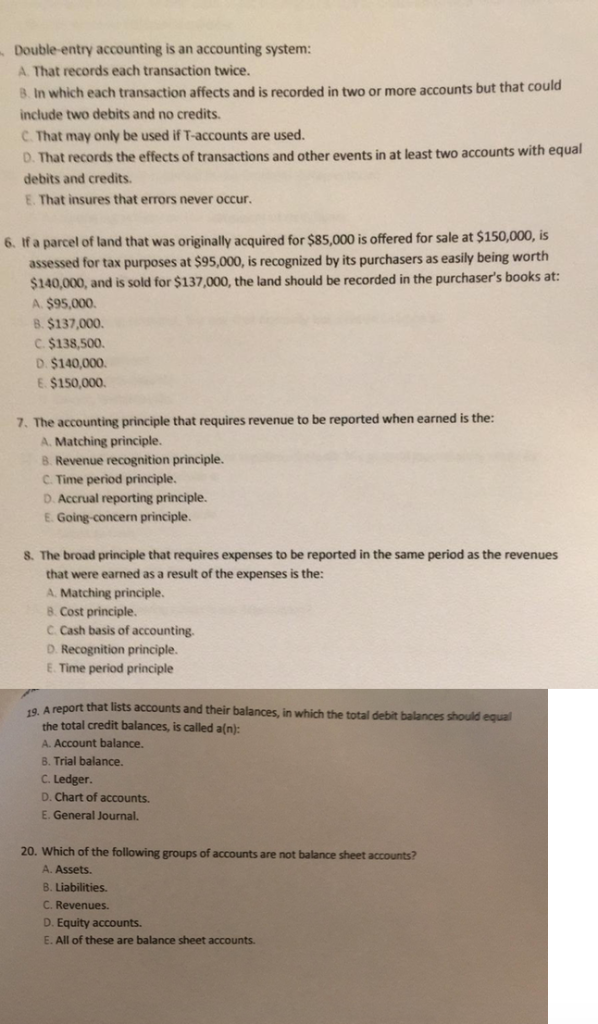

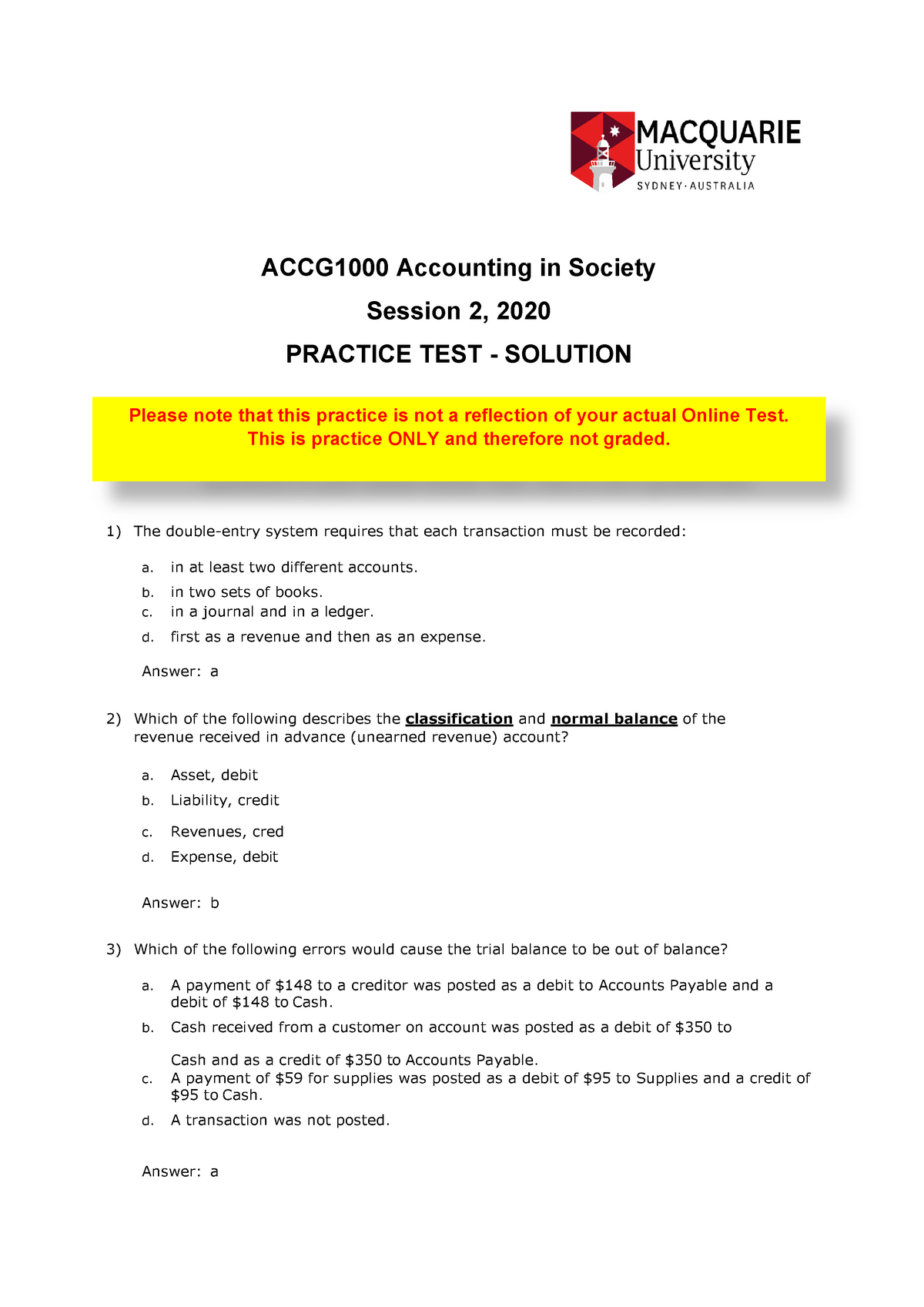

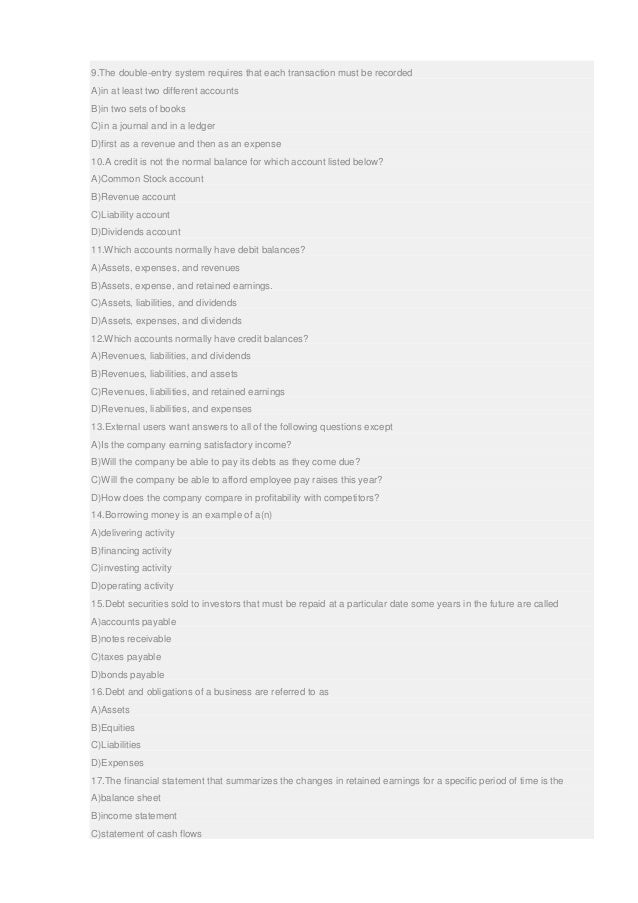

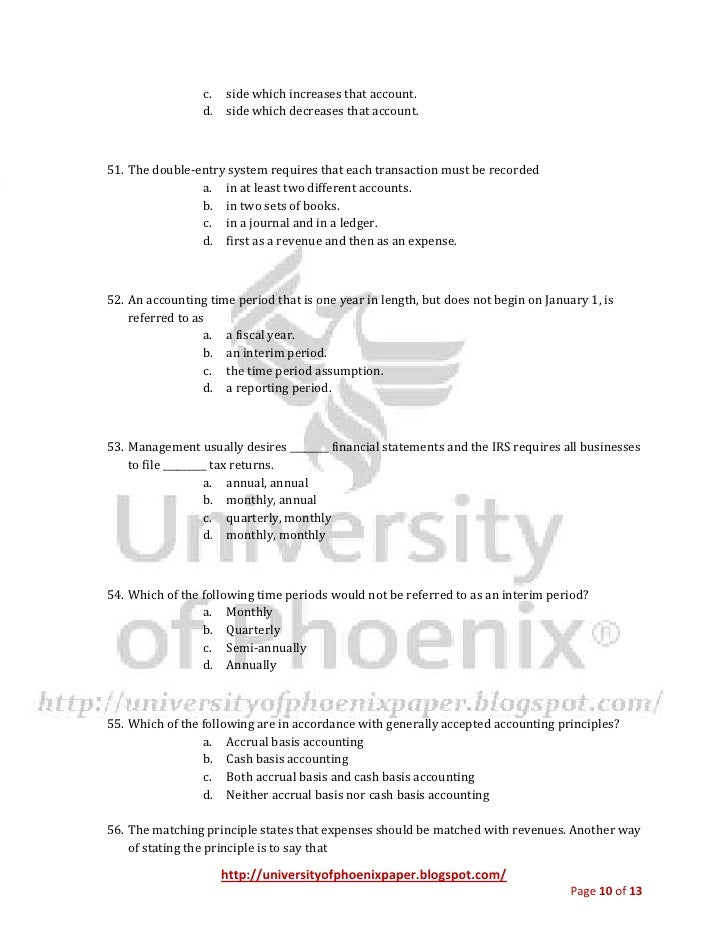

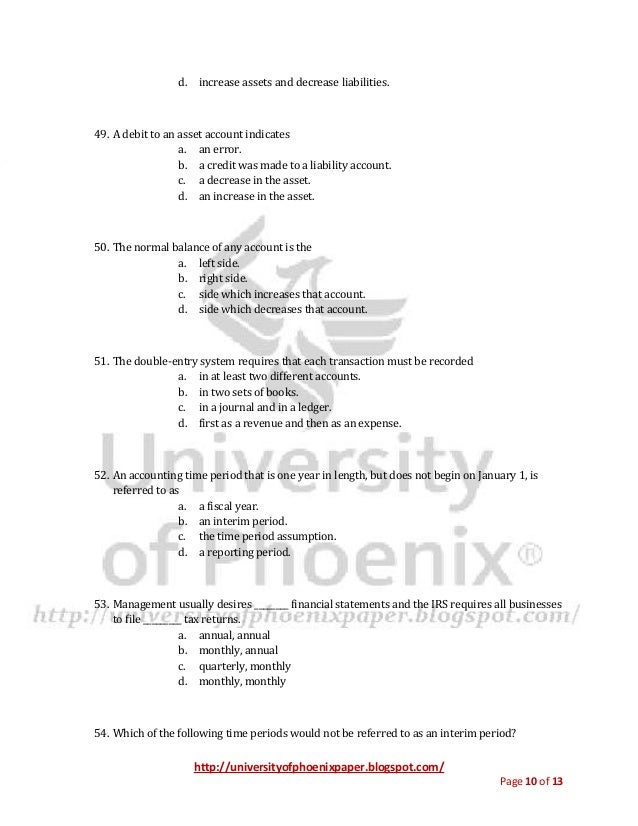

The double-entry system requires that each transaction must be recorded. In at least two different accounts. In two sets of books. In a journal and in a ledger c.

In at least two different accounts. In the journal and in the ledger c. In at least two different accounts.

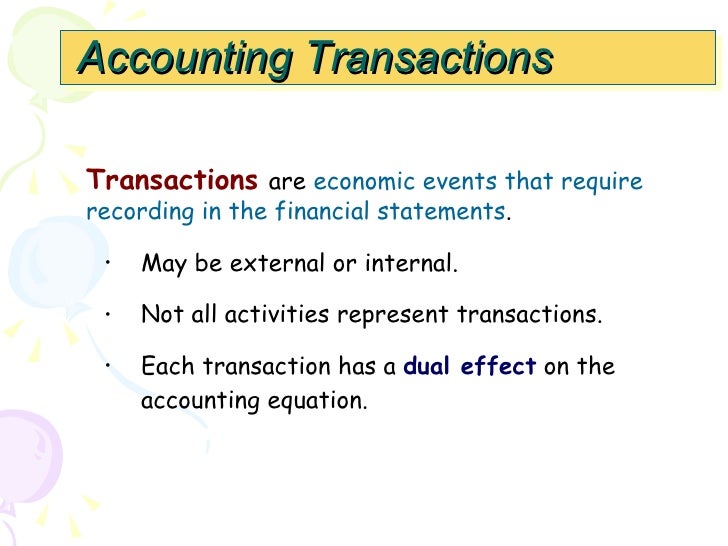

The double entry system requires two entries for each transaction. In two sets of books in a journal and in a ledger first as a revenue and then as an expense Kingstons trial balance includes a balance for his drawings How should this balance be treated in the financial statements. In a journal and in a ledger.

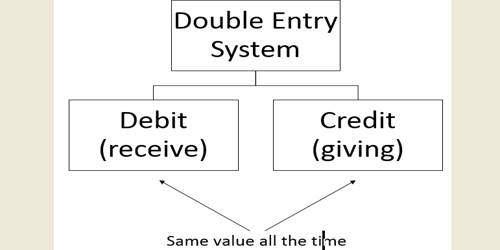

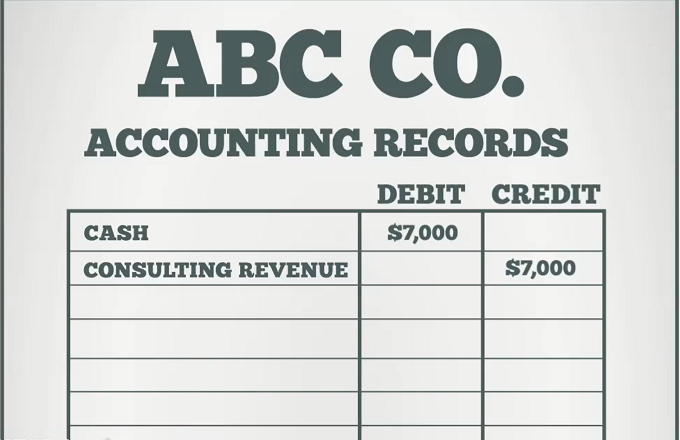

The double-entry system also requires that for all transactions the amounts entered as debits must be equal to the amounts entered as credits. In a journal and in a ledger. The double-entry system requires that each transaction must be recorded a.

First as a revenue and then as an expense. Under double entry system of accounting the two aspects of each transaction are recorded ie for every debit there must be a credit and vice versa. Since both the aspects of a transaction are recorded for each debit there must be a corresponding credit of an equal amount.

The double-entry system requires that each transaction must be recorded a. In a journal and in a ledger. Under the double-entry system revenues must always equal expenses.

The double-entry system requires that each transaction must be recorded a. Question 1 A double-entry accounting system requires that each transaction or event be recorded.

The double-entry system requires that each transaction must be recordedAin at least two different accountsBin two sets of booksCin a journal and in a.

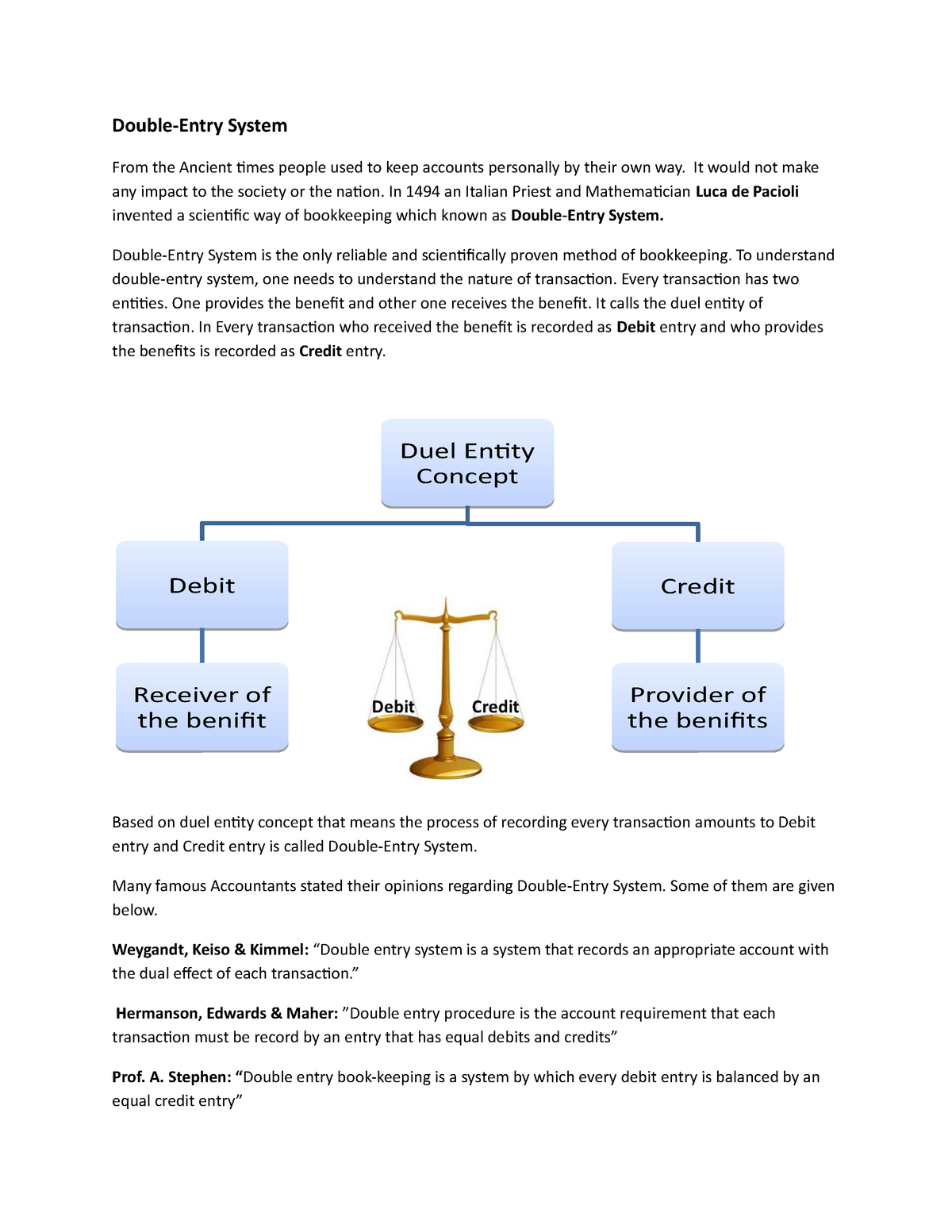

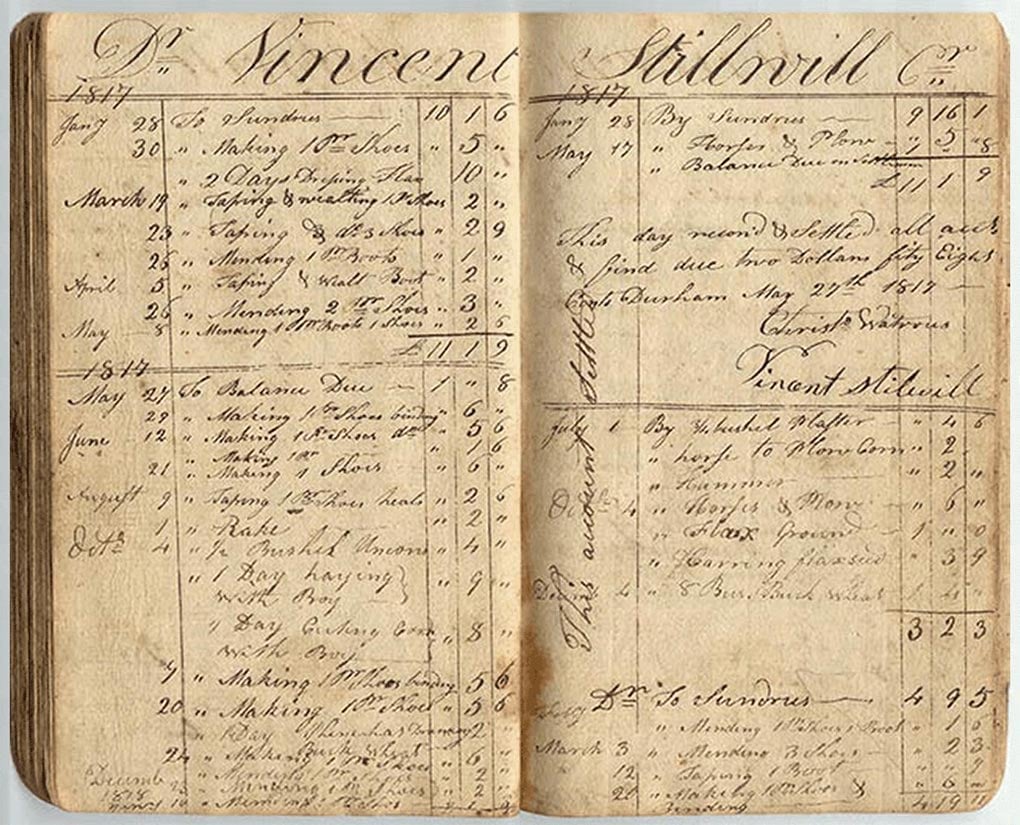

The double entry system of bookkeeping can be defined as the system of recording transactions having two fundamental aspects - one involving the receiving of a benefit and the other giving the benefit - in the same set of books. The double-entry system requires that each transaction must be recorded in at least two different accounts B. In Accounting Double entry system is a method of book keeping that entering the values into the booksAccording to the double entry accounting principle every transaction of business must be recorded in two sides ie. Both a and c are correct Explanation. In this theory as the two fold aspects of each transaction are recorded therefore it is called double entry system. In at least two different accounts. Since both the aspects of a transaction are recorded for each debit there must be a corresponding credit of an equal amount. The double entry system requires that each transaction must be recorded a in at from DERE 101 at Universidad de Los Andes. In a journal and in a ledger.

In at least two different accounts. First as a revenue and then as an expense. The double entry system requires that each transaction must be recorded a in at from DERE 101 at Universidad de Los Andes. A debit and a credit. False Transactions are entered in the ledger first and then they are analyzed in terms of their effect on the accounts. Definition of Double-Entry System. The double-entry bookkeeping system also called double-entry accounting is a common accounting system that requires every business transaction to be entered in at least two different accounts.

/Shopkeeperdoinghismonthlybookkeeping-5bdf55fa46e0fb0026b2b998.jpg)

Post a Comment for "The Double-entry System Requires That Each Transaction Must Be Recorded"